Do you care for your elderly parents? If so, you could be eligible for Carer’s Allowance. This is a government benefit that supports people who provide unpaid care.

Caring for your parents can be very rewarding, but it can also place a strain on your finances. That’s why it’s so important to claim any support that you can. In this simple guide to Carer’s Allowance, we’ll explain how you qualify and how much you could receive.

What is Carer's Allowance?

Carer’s Allowance is a taxable benefit available to anyone over 16 who provides continuous care to another person. Many people may not think of themselves as a carer. However, you probably are if you regularly care for a loved one. In fact, there are more than 1.4 million people providing unpaid care every week in the UK.

The Carer's Allowance benefit was introduced in 1976 and is designed to operate as an ‘income replacement’ benefit. It is intended to aid with living costs for people who cannot work full-time due to their caring responsibilities.

This is an important benefit to consider applying for; 600 people give up work every day to care for their loved ones. Plus, more than a third of carers claim they are or have been in debt. Carer’s Allowance could help alleviate these worries by covering the cost of equipment and other monthly expenses.

Can I Claim Carer's Allowance?

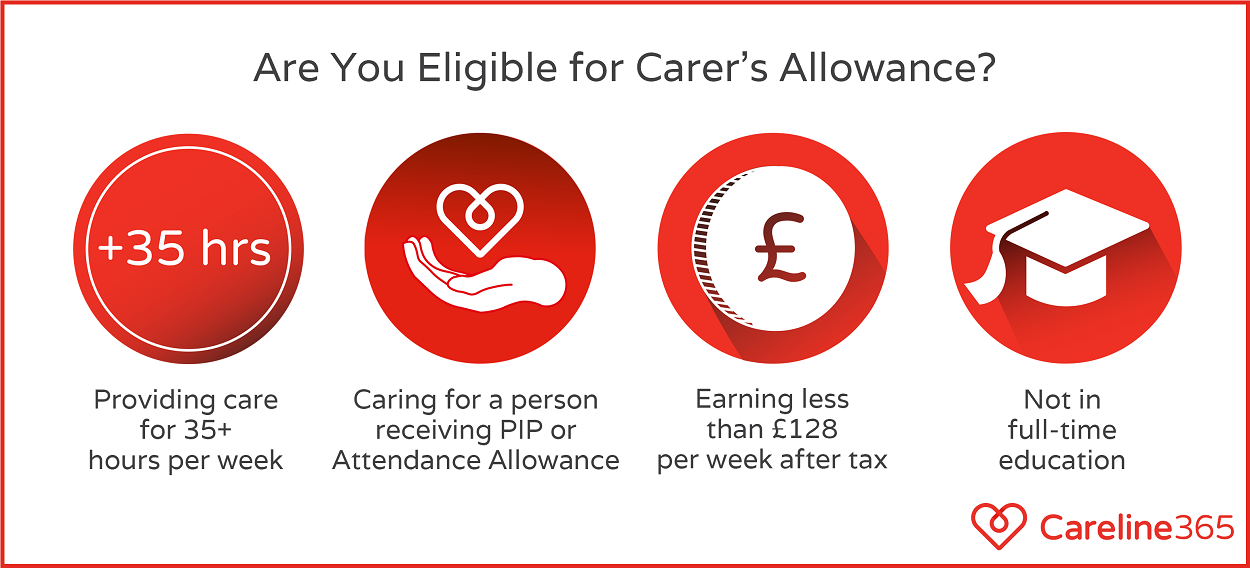

You could be eligible for Carer's Allowance if you meet the following criteria:

- You spend at least 35 hours per week caring for someone.

- The person you care for receives Disability Living Allowance (DLA), Personal Independence Payment (PIP), or Attendance Allowance.

- You don't earn more than £151 per week after tax.

- You aren't in full-time education.

Despite what you may assume, you don't have to be related to the person you're caring for in order to claim Carer's Allowance. It could be your elderly parent(s), another relative, a friend, or a neighbour.

However, it is important to remember that if you provide care to more than one person you can only make one application. You must be providing at least 35 hours of care to one of the people you are caring for. Similarly, if more than one person is providing care to the same person, only one of you can apply for Carer’s Allowance.

How Much Could I Get?

The rate of Carer's Allowance changes every tax year (from 6 April one year to 5 April the next year). For the 2024/25 tax year, the rate has been set at £81.90 per week.

If you receive any other benefits, claiming Carer's Allowance for looking after elderly parents could affect how much you receive.

For example, you cannot receive the full amount of both Carer's Allowance and the State Pension. If the amount you receive from your State Pension is more than Carer's Allowance, you won't receive any Carer's Allowance money. However, if your State Pension is less, you'll get the difference paid in Carer's Allowance.

This extra amount is called a Carer's Premium or Carer's Addition. We know that these rules can be quite complicated, so we would recommend contacting your local Citizens Advice centre for more information.

However, even if you can't receive any money from Carer's Allowance, it's still worth making a claim as you can be awarded an 'underlying entitlement'.

Underlying Entitlement

This term essentially means that you meet the criteria for Carer's Allowance but you cannot receive the money as it overlaps with another benefit e.g. State Pension. However, this can still be a helpful thing to have. An underlying entitlement can increase any means-tested benefits you already receive or help you qualify for other means-tested benefits for the first time.

Remember, means-tested benefits will depend on your income and savings (as well as your partner's income and savings, if applicable).

How To Claim

If you want to claim for caring for your elderly parents, there are a few ways to apply. You can use the government's online form by clicking here.

Alternatively, you can apply by post – you'll need to print off a paper form and fill it in. Click here to download and print the relevant forms.

While you cannot apply by telephone, you can call the Carer's Allowance Unit on 0800 731 0297 for help with your claim.

What If I Don't Qualify?

If your application is not successful, you have a few options. You may wish to ask for a written statement of the reasons behind their decision. You will then be able to use this as evidence when you request a 'mandatory reconsideration'.

This is the first step of the appeal process. It gives the benefits office the opportunity to review the reasons behind the original decision and reconsider. To request a mandatory reconsideration, you'll need to write to the address on your original decision letter. You should include the reasons why you think the decision is wrong as well as any evidence to support your claim.

Be sure to submit this request as soon as possible after receiving the initial decision – there should be a deadline on your original decision letter.

You'll then receive a mandatory reconsideration notice in the post. This will tell you whether your claim has been granted or denied. From there, you'll usually have up to one month to appeal the decision. Click here to submit an appeal or learn more about the appeals process.

Other Benefits

If you are caring for an elderly parent, Carer's Allowance is there to support you. There are also other benefits which you and your parents may be able to claim.

For more information, read our helpful guide to benefits for elderly people.

Alternatively, you can read our individual articles on benefits you can receive:

However, keep in mind that other benefits may impact or be impacted by the amount of Carer's Allowance you receive.

How Careline Can Help

When you provide regular care to a loved one, it is natural to worry about their wellbeing. It is an unfortunate truth that you cannot always be there to assist them. This may leave you anxious about leaving them on their own, and respite care isn’t cheap.

A Careline Alarm may be the solution. By purchasing a personal alarm, your loved one will be connected to our 24/7 Care Team. This allows them to request support at any time.

When your loved one activates their alarm by pressing their pendant alarm button, they will be put through to our Care Team. They will speak with your loved one to determine the nature of the emergency. If necessary, we will also alert the emergency services.

The next step will be to inform you and any other emergency contacts. This means that you can be made aware that they need help no matter where you are.

As such, you can count on our personal alarms to provide extra peace of mind when you are providing care.

For additional reassurance, our Fall Detector and GPS products come with a range of additional benefits.

A Fall Detector Alarm is automatically activated if your loved one has a fall. Our team will follow the same procedure as if they activated it manually, meaning you will be immediately informed.

Alternatively, if your loved one may require assistance outside of their home, then a GPS Alarm is a wise investment. Unlike our other alarm packages, the GPS alarm is not limited by a base unit. Instead, it uses a mobile connection to ensure it can always alert our team.

This means you can feel reassured knowing support is on hand. A Careline alarm can also improve your loved one’s peace of mind if they are temporarily unattended.

To find out more about the Careline alarm service, or to place an order, get in touch with our friendly team today on 0800 030 8777. Additional information can be found in our guide to the alarm service, and you can find more helpful articles like this by checking out our blog.